37+ mortgage interest rate tax deduction

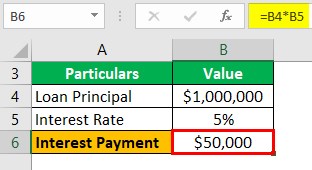

Web Here is an example of what will be the scenario to some people. The interest on an additional.

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

File Online or In-Person Today.

. Homeowners who bought houses before December 16 2017 can. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Ad Shortening your term could save you money over the life of your loan.

Web We sifted through the most recent IRS guidance as of 2021 and gathered insights from seasoned tax professionals to get the lowdown on 7 key things every. Ad Learn How Simple Filing Taxes Can Be. Come tax time you would use the rental income and expenses.

Ad Free For Simple Tax Returns Only With TurboTax Free Edition. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web Basic income information including amounts of your income. Web These tax deductions can lower your tax liability.

Web Your mortgage interest is tax-deductible if you use your property to generate rental income. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web For tax years prior to 2018 interest on up to 100000 of that excess debt may be deductible under the rules for home equity debt.

Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household. However higher limitations 1 million 500000 if married. Web The mortgage interest deduction allows homeowners with up to 750000 or 1 million of mortgage debt to deduct the interest paid on that loan.

Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. The government actually lowered the limit in 2018. Discover How HR Block Makes It Easier to File Your Way.

Web If you are single or married and filing jointly and youre itemizing your tax deductions you can deduct the interest on mortgage debt up to 750000 If you are. Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct the interest paid during the tax year on as. Ad Shortening your term could save you money over the life of your loan.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Over 12M Americans Filed 100 Free With TurboTax Last Year. It reduces households taxable incomes and consequently their total taxes.

See If You Qualify Today. Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages. 5 Steps to Successful Real Estate Accounting for Investing Newbies.

What is the home mortgage. Start Today to File Your Return with HR Block. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65. Also you can deduct the points. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage.

Web The maximum limit on mortgage interest deductions is 750000. Web For tax years before 2018 the interest paid on up to 1 million of acquisition indebtedness is deductible if you itemize deductions. Before then it was set at 1 million.

Web Most homeowners can deduct all of their mortgage interest.

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Deduction A Guide Rocket Mortgage

Typical Mortgage Payment To Climb More Than 50 Bmo Economist R Canada

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

How To Maximize Your Mortgage Interest Deduction Forbes Advisor

What If Interest Expenses Were No Longer Tax Deductible The Economist

How To Maximize Your Mortgage Interest Deduction Forbes Advisor

Mortgage Interest Deduction What You Need To Know Mortgage Professional

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

What Expenses Can Be Deducted From Capital Gains Tax

Mortgage Interest Deduction How It Calculate Tax Savings

Mortage Interest Deduction What Is The Mortgage Interest Deduction

What Is The Mortgage Interest Deduction The Motley Fool

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

A Guide To Buy To Let Mortgage Interest Tax Relief Sevencapital

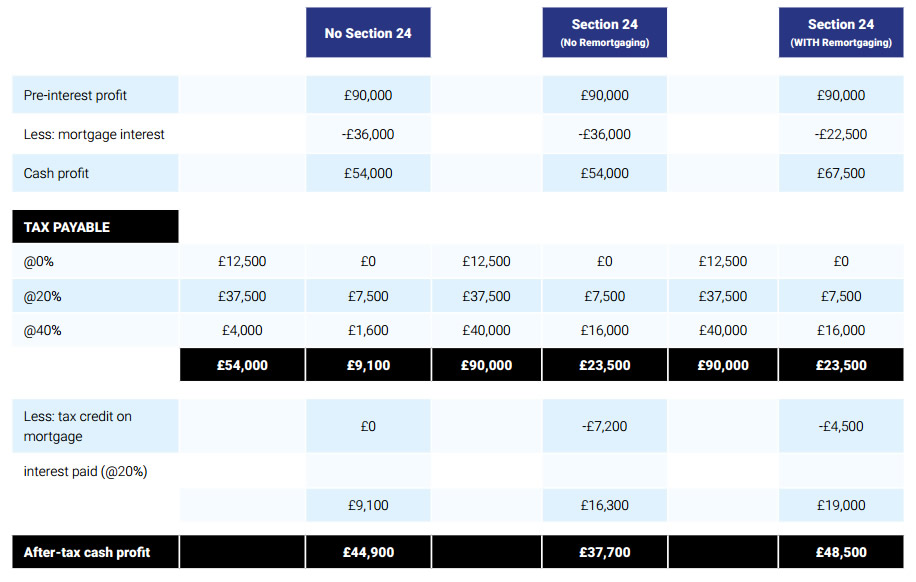

Strategic Re Mortgaging To Mitigate Section 24 Mortgage Interest Relief Restrictions Fylde Tax Accountants

Mortgage Interest Deduction Bankrate